In my previous blog post, I outlined in general terms some of the key features of the Insight Rabbit DIY research platform. Starting with this post, we will get into the specifics of each individual product offered on the Insight Rabbit platform, illustrated with the results from an example project.

This first installment will focus on TouchPoint*Pulse Lite (which I will henceforth refer to as “Pulse Lite”). Pulse Lite is a quick version of MSW Research’s sales-validated TouchPoint® advertising effectiveness testing product. Pulse Lite includes only the essential decision criteria metrics which have been proven to relate to in-market sales results. This makes it an ideal choice when evaluating multiple pieces of rough advertising to decide which to advance for further development; or for qualifying finished ads for media deployment. And at a highly affordable price point, Pulse Lite enables advertisers to vet multiple options even when budgets are tight.

Before we get to the example and the specific deliverables available from Pulse Lite, let’s first go over exactly what we mean by “essential decision criteria metrics”. These are the measures of the advertising’s overall effectiveness which can be relied on for making the correct decision on whether to air or continue developing an advertising execution. Pulse Lite includes two such metrics: CCPersuasion® and Break ThroughTM.

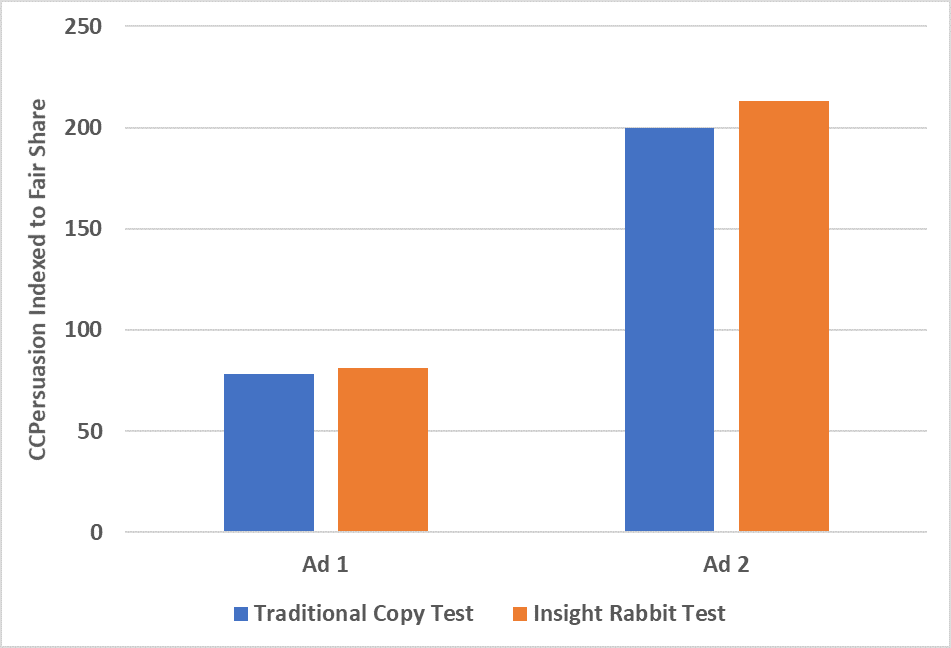

CCPersuasion, the more influential of the two metrics in terms of projecting short term market expectations, represents the shift in preference for the advertised brand as a result of incidental exposure to the test advertising. This metric has a long history and in fact Quirk’s once stated that it “has been validated to actual business results more than any other measure in the business.” The Insight Rabbit implementation of this metric lines up with MSW Research’s standard (and extensively validated) CCPersuasion metric. As an example, a recent replication of an MSW client’s standard copy test with Insight Rabbit showed near identical results for two separate video ads.

In terms of normative comparisons, the CCPersuasion result is compared to MSW Research’s unique Fair Share benchmark. Fair Share represents the CCPersuasion level an average ad for the test brand should achieve, given the brand’s size, number of competitors in the market and loyalty characteristics of consumers in the category. These inputs to Fair Share are derived within the copy test itself, meaning a relevant norm is always available regardless of the test brand’s category (for more information, see these Fair Share blog postings: part I, part II).

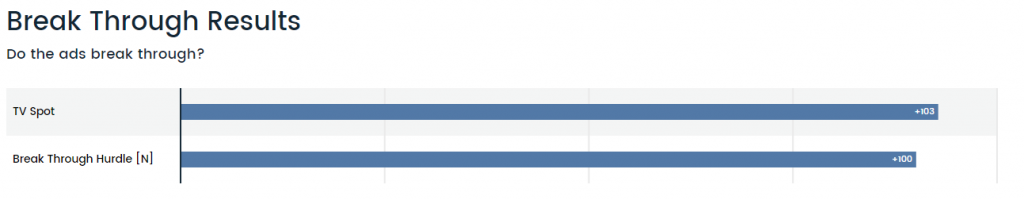

The secondary decision criteria metric is Break Through. This measure represents the ability of the ad to capture viewer attention and leave a branded impression. It is simply the percent of respondents who recall seeing an ad for the test category and can correctly identify the test brand after incidental exposure to the ad and some intervening, unrelated survey content.

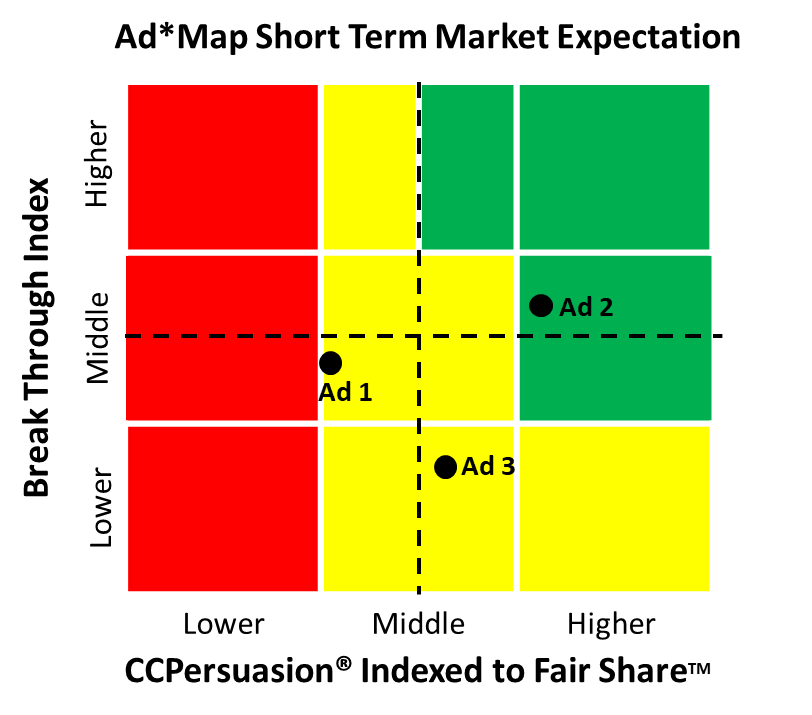

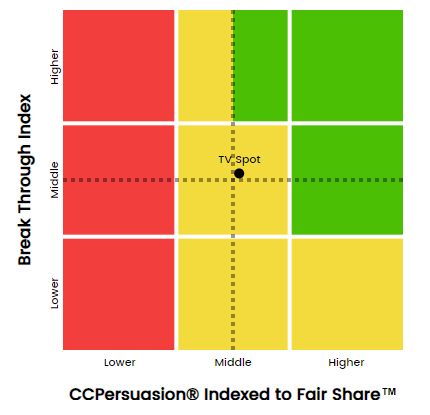

Taken together, these two proven metrics form the basis of Pulse Lite’s assessment of an ad’s overall effectiveness in the form of our unique Ad*Map.

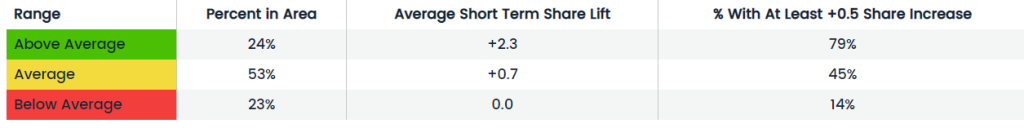

Ads are plotted on the Ad*Map according to their performance on the two key evaluative metrics and color coding is given to provide context in terms of historical in-market performance of ads falling in the same region of the map.

Pulse Lite has specific versions designed for Video, Print and static Digital ad formats. For our example we have chosen to test a recent video ad from KFC, featuring a robotic incarnation of that venerable poultry purveyor, Colonel Sanders.

As with all Insight Rabbit offerings, set-up of the test survey is fast and easy with our step-by-step user interface (and we are also there to Do-It-Together with you if you happen to need any help). In this case, we chose to test the KFC ad with a Gen Pop sample of 200.

Overall the KFC ad’s sales effectiveness is “average”, falling very close to the center of the Ad*Map plot. This is not bad, as around half of all tested ads appear in the “average” region of the Ad*Map. So while the chicken may not have been flying off the shelves when this spot hit the air, the ad should have had a positive impact on KFC sales results.

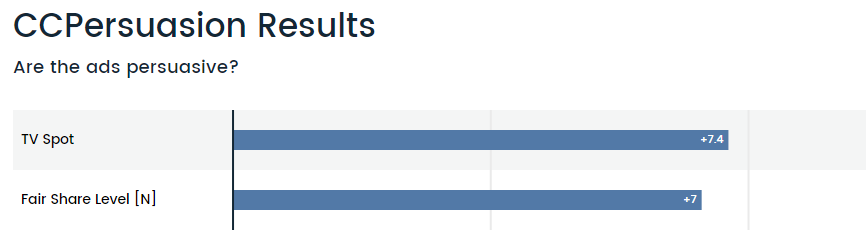

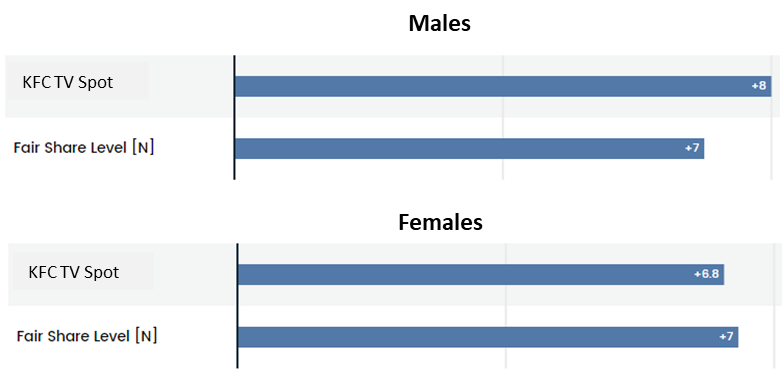

Next, we can see that the ad’s CCPersuasion score was directionally, but not significantly, above the Fair Share benchmark among the total sample.

As with all Insight Rabbit charts, this chart is filterable by category purchase and by several standard demographic dimensions. Among other things, these additional data cuts revealed that this particular ad played somewhat more favorably among men than among women:

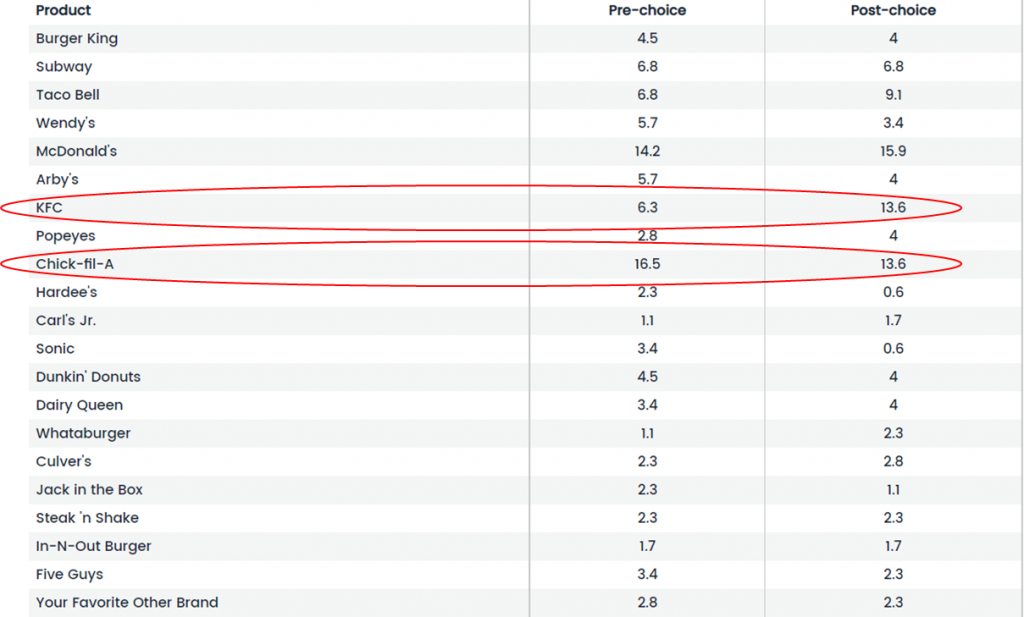

Pulse Lite also provides a table of brand preference levels for all brands in the category’s competitive set both pre- and post-exposure to the test ad. For the KFC ad among total sample, not only do we see the increase in preference for KFC resulting from exposure to the ad, we also see that the brand with the largest decline in preference was another chicken-focused QSR competitor – Chick-fil-A.

In terms of Break Through, among total sample this KFC ad is not significantly above the Break Through hurdle. This rather average result may seem somewhat puzzling given that the ad focused on a representation of Colonel Sanders throughout and has what would seem to be a unique and attention catching approach. But at the same time, the KFC brand name is never spoken and is only shown on-screen at the very end. This lack of explicit branding may then be counterbalancing the positive branding effect of the focus on Colonel Sanders and his secret recipe.

Interestingly, using Insight Rabbit’s subgroup filtering we find that the ad’s Break Through result is much stronger among respondents aged 50+. It may be that the use of Sanders is more salient among the older audience since he was a prominent spokesperson for the brand up until his death in 1980, after which his character was used sparingly in advertising up until the last few years when he has regained prominence in the brand’s promotional efforts.

Finally, despite my previous statement that Pulse Lite includes only decision criteria metrics, it does also include an open-ended main point question. The verbatims from this question can be used to ensure the ad’s communication objectives are reaching respondents and as a disaster check that nothing unintended is being taken away. A word cloud deliverable shows that communication of “secret recipe” – ostensibly the focus of the ad – is strong with respondents.

So with Pulse Lite we have learned quite a bit about this ad’s overall effectiveness and performance among subgroups. However to gain a more in-depth understanding of the drivers of an ad’s performance, you may choose to use the full TouchPoint*Pulse methodology. Pulse includes the same decision criteria metrics as Pulse Lite along with an extensive array of diagnostic methodologies. In our next blog post we will revisit the same KFC ad using Pulse’s diagnostic tools to bring a better understanding of the ad’s “average” performance. In the meantime, if you have any questions please visit www.insightrabbit.com or send us a note at hello@insightrabbit.com.